Asia

EMEA

LANXESS Canada Contacts

Contact our Sites in Canada

Media Inquiries

General Inquiries

Please click here to e-mail LANXESS Canada with product inquiries and general requests.

Global Press Releases

2016-11-10

LANXESS again raises guidance for 2016 after strong third quarter

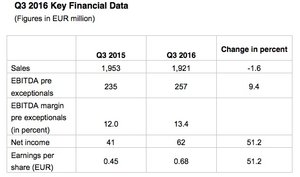

- FY 2016: EBITDA pre exceptionals now expected to be between EUR 960 million and EUR 1,000 million

- Q3 2016: EBITDA pre exceptionals up 9.4 percent to EUR 257 million

- EBITDA margin increases to 13.4 percent due to higher volumes across all segments and improved cost structures

- Net income improves by a substantial 51.2 percent to EUR 62 million

- Planning for Chemtura integration started

Following a strong third quarter, specialty chemicals company LANXESS has again raised its earnings guidance for 2016. The Cologne-based company now expects to achieve EBITDA pre exceptionals within a corridor of EUR 960 million and EUR 1,000 million. Previously, LANXESS had assumed earnings of between EUR 930 million and EUR 970 million.

EBITDA pre exceptionals for the third quarter of 2016 rose by 9.4 percent to EUR 257 million, compared with EUR 235 million a year earlier. The EBITDA margin pre exceptionals improved year-on-year from 12.0 percent to 13.4 percent. As in the preceding three-month period, the good overall earnings performance was due especially to the strong operational development of the “new” LANXESS segments – Advanced Intermediates, Performance Chemicals and High Performance Materials – and to improved cost structures.

“We took the momentum from the first half of the year into the third quarter and delivered renewed proof of the operational strength of “new” LANXESS. We are therefore again raising our guidance for the full year,” said Matthias Zachert, Chairman of the Board of Management of LANXESS AG. The company is anticipating a normal seasonal business pattern in the final quarter of 2016. In other words, performance will be slightly subdued compared with the preceding quarters.

The good business development in the third quarter was also reflected in net income, which increased by 51.2 percent to EUR 62 million from EUR 41 million the previous year. Earnings per share were EUR 0.68, after EUR 0.45 a year earlier.

Group sales declined by a slight 1.6 percent in the third quarter of 2016 to EUR 1.92 billion, compared with EUR 1.95 billion in the same period in 2015. Higher volumes in all segments nearly compensated for the lower selling prices resulting from raw material prices.

Advancing on the path of growth

LANXESS continued its path of growth in the third quarter as well. On August 31, 2016, it successfully closed the acquisition of the Clean and Disinfect business of U.S-based company Chemours. At the end of September, LANXESS then announced the next milestone with the planned acquisition of U.S-based chemical company Chemtura, thus positioning itself as a leading supplier of additives. Several working groups have now started planning the integration process. The transaction still needs to be approved by Chemtura’s shareholders and the relevant antitrust authorities and is subject to the standard conditions applying to such transactions. Closing is expected around mid-2017.

Net financial liabilities remain at a low level

At the end of the third quarter, net financial liabilities were virtually unchanged at a low level, despite payment for the acquisition of the Chemours business, and amounted to EUR 203 million. Net Debt was substantially reduced by, in particular, the payment of EUR 1.2 billion received by LANXESS in April 2016 from Saudi Aramco for its 50-percent share in the ARLANXEO joint venture. At the end of 2015, LANXESS still had net financial liabilities of around EUR 1.2 billion.

Margins improved in all segments

In the Advanced Intermediates segment, sales decreased by 1.1 percent from EUR 440 million to EUR 435 million. EBITDA pre exceptionals stood at EUR 83 million, 9.2 percent higher than the prior-year figure of EUR 76 million. In the Advanced Industrial Intermediates business unit particularly, sales volumes increased on account of good demand in almost all end markets. In the Saltigo business unit, demand for Saltidin – the active ingredient for insect repellents – was one of the factors which compensated for weaker demand for agrochemicals. The EBITDA margin pre exceptionals of 19.1 percent was significantly above the prior-year figure of 17.3 percent.

The Performance Chemicals segment posted a year-on-year increase in sales of 3.2 percent, from EUR 524 million to EUR 541 million. Alongside higher sales volumes, the Clean and Disinfect business acquired from Chemours at the end of August was one of the factors in this performance. EBITDA pre exceptionals increased by 5.8 percent to EUR 91 million, compared with EUR 86 million a year earlier. In particular, higher sales volumes in almost all business units contributed to the improvement in earnings. The EBITDA margin pre exceptionals increased slightly from 16.4 percent to 16.8 percent.

Sales in the High Performance Materials segment declined slightly by 2.3 percent to EUR 257 million from EUR 263 million in the prior-year quarter. Increased sales volumes almost compensated for the lower selling prices resulting from raw material costs. EBITDA pre exceptionals increased by a substantial 31.3 percent to EUR 42 million, compared with EUR 32 million in the third quarter of 2015. Higher sales volumes in more profitable product groups and improved capacity utilization resulted in this positive earnings performance. The EBITDA margin pre exceptionals of 16.3 percent was significantly above the figure of 12.2 percent posted in the prior-year quarter.

Sales in the ARLANXEO segment decreased by 5.3 percent to EUR 675 million, compared with EUR 713 million a year earlier. In particular, good demand from the automotive segment in Asia resulted in higher sales volumes. However, these were unable to offset the price decline resulting from raw material costs. EBITDA pre exceptionals stood at EUR 91 million, just 3.2 percent lower than the prior-year figure of EUR 94 million. Higher volumes and improved capacity utilization counteracted the impact of continuing price pressure. The EBITDA margin pre exceptionals improved slightly to 13.5 percent, compared with 13.2 percent in the prior-year period.

LANXESS is a leading specialty chemicals company with sales of EUR 7.9 billion in 2015 and about 16,700 employees in 29 countries. The company is currently represented at 54 production sites worldwide. The core business of LANXESS is the development, manufacturing and marketing of chemical intermediates, specialty chemicals and plastics. Through ARLANXEO, the joint venture with Saudi Aramco, LANXESS is also a leading supplier of synthetic rubber. LANXESS is listed in the leading sustainability indices Dow Jones Sustainability Index (DJSI World) and FTSE4Good.